NFTs are a great investment avenue, provided you know what you’re doing. However, the key to making better NFT purchases and trades is understanding the concept entirely and doing your thorough research.

There are several different factors that play a role in determining the value of an NFT other than the public interest, which often drives NFT prices. In this article, we’re taking a look at what is Floor Price in NFTs.

Also read: Opensea vs Rarible vs Mintable: 4 key differences

What is NFT Floor Price?

The floor price is the lowest amount of money you’ll have to spend to buy an NFT belonging to a particular project. Floor prices are set by individuals who own NFTs in a specific project and list them for sale cheaper than others listing their NFTs for the same project. This price is updated in real-time.

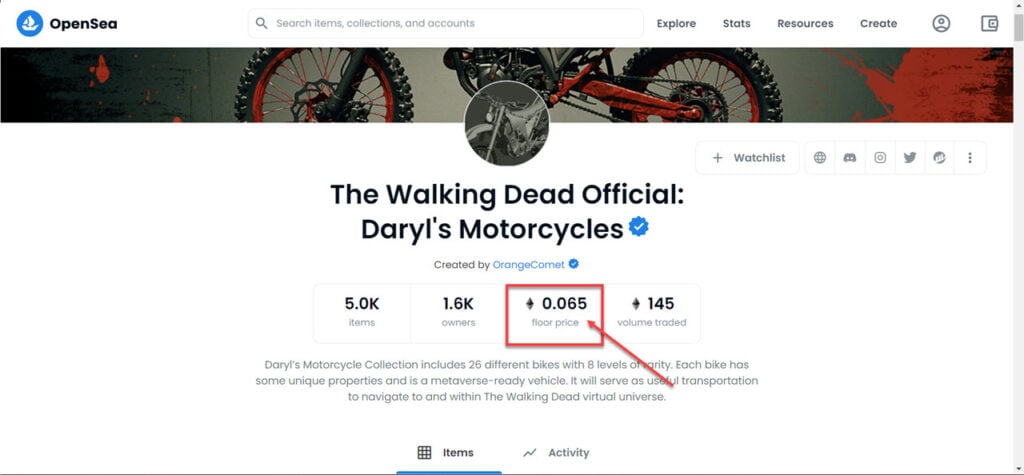

For example, the official Walking Dead collection of Daryl’s Motorcycles has a floor price of 0.065ETH. This means that you can get one NFT from that project for the said price.

Usually, an economics term used to describe how low a price can be for a specific commodity, the floor price is one of the most widely used metrics in valuing an NFT project.

Floor price purchases are usually made to join a particular NFT club to enjoy the perks that come with owning an NFT from a specific collection. However, NFTs being sold at or near the floor price generally do not have rare properties or traits, making them less valuable, hence the lower price.

Other factors play a part in evaluating the value of an NFT other than the floor price as well. The trading volume is also a very good indicator of how active a project is as it lists the number of active trades that have happened inside a collection.

Also read: An error occurred while processing your request in Opensea: 5 Fixes